Special report: Legal woes mount for a foreclosure kingpin

Fall leaves blow past an empty home (C) seen in a well kept neighborhood where the house is listed on the auction block during the Wayne County tax foreclosures auction of almost 9,000 properties in Detroit, Michigan, October 22, 2009. Credit: Reuters/Rebecca Cook

By Scot J. Paltrow

JACKSONVILLE, Florida | Mon Dec 6, 2010 2:10pm EST

JACKSONVILLE, Florida (Reuters) – Lender Processing Services is riding the waves of foreclosures sweeping the United States, but in late October its CEO, Jeff Carbiener, found himself needing to reassure investors in the $2.8 billion company.

Although profits were rolling in, LPS’s stock had taken a hit in the wake of revelations that mortgage companies across the country had filed fraudulent documents in foreclosures cases. Earlier in the year, the company, which handles more than half of the nation’s foreclosures, had disclosed that it was under federal criminal investigation and admitted that employees at a small subsidiary had falsely signed foreclosure documents.

Still, Carbiener told the Wall Street analysts in an October 29 conference call that LPS’s legal concerns were overblown, and the stock has jumped 13 percent since its close the day before the call.

But a Reuters investigation shows that LPS’s legal woes are more serious than he let on. Public records reveal that the company’s LPS Default Solutions unit produced documents of dubious authenticity in far larger quantities than it has disclosed, and over a much longer timespan.

Questionable signing and notarization practices weren’t limited to its subsidiary, called DocX, but occurred in at least one of LPS’s own offices, mortgage assignments filed in county recorders’ offices show. And rather than halt such practices after the federal investigation got underway, the company shifted the signing to firms with which it has close business ties. LPS provided personnel to work in the new signing operations, according to information from an LPS spokeswoman and court records including an October 21 ruling by a judge in Brooklyn, New York. Records in county recorders’ offices, and in the judge’s opinion, show that “robosigning” and preparation of apparently false documents went on at these sites on a large scale.

In one instance, it helped set up a massive signing operation at the nearby office of a major client, a spokeswoman for the client, American Home Mortgage Servicing, confirmed. LPS-hired notaries who worked there said in interviews that troves of documents were improperly handled. They said that about 200 affidavits per day were robosigned during the two months the two notaries remained there.

A spokeswoman for LPS confirmed to Reuters that it had helped other firms establish operations that performed the same function. LPS spokeswoman Michelle Kersch didn’t specify which firms. But beginning early in 2010, county recorders’ records show, signing shifted also to law firms under contract with LPS.

Interviews with key players and court records also show that pending investigations and lawsuits pose a bigger threat to the company than Carbiener let on.

The criminal investigation in Jacksonville by federal prosecutors and the Federal Bureau of Investigation is intensifying. The same goes for a separate inquiry by the Florida attorney general’s office. Individuals with direct knowledge of the federal inquiry said that prosecutors have impaneled a grand jury, begun calling witnesses and subpoenaed records from LPS.

The company confirmed to Reuters that it has hired Paul McNulty, former deputy U.S. attorney general in the George W. Bush administration, to represent it in the investigation. A spokeswoman for the U.S. Attorney’s office declined to comment on the probe.

The U.S. Comptroller of the Currency’s office, which is responsible for supervising national banks, also announced in November that it had teamed up with the Federal Reserve to conduct an on-site examination of LPS.

Meanwhile, the threats from four class action lawsuits filed in federal courts appear to be greater than the company has indicated, especially one filed in Mississippi. In a highly unusual move, a unit of the U.S. Justice Department has joined that suit as a plaintiff. The lawsuit alleges that LPS extracted many millions of dollars in kickbacks from law firms through an illegal fee-sharing arrangement, in exchange for doling out lucrative foreclosure work to them.

The lawsuit also charges that LPS illegally practices law and routinely misleads homeowners and federal bankruptcy judges. Carbiener has said there is little reason to worry about the Mississippi suit because the company already prevailed in a federal lawsuit in Texas that had made nearly identical accusations. But court records in that case show that the lawsuit was dropped without any ruling on the merits of the allegations.

Copies of LPS internal documents obtained by Reuters and testimony in lawsuits shed new light on the company’s unusual dealings with its vast network of law firms. LPS relentlessly pressed them for speed. The result was almost instant filing of foreclosure documents, mostly prepared by clerical workers, not lawyers, according to court records, including deposition testimony by LPS officials. Several judicial opinions from around the country and evidence from investigations in Florida show that these documents often were riddled with inaccurate information about the amount homeowners owed, and were signed and notarized en masse without anyone at the firms checking the information in them.

Under LPS’s system, law firms that were slower, often because their lawyers carefully prepared and reviewed court documents before filing them, were effectively punished, according to deposition testimony and other sources. The computer automatically assigned bad ratings to these firms, and the flow of work assignments to them dried up.

A BOOMING BUSINESS

Few firms benefited more from the collapse of the U.S. housing boom than LPS. Spun off as an independent company in 2008, the company has seen its profits, with big help from its mortgage default services business, reach $232 million for the first nine months of 2010. That is a nearly 15 percent increase from the same period in 2009. Its revenue last year was $2.4 billion, up from $1.8 billion in 2008.

And business continues to surge. Carbiener told analysts on the October 29 call that “we continue to gain market share across all key business segments.” In a November 23 report prepared for investors and clients, LPS said banks are pushing to foreclose on properties as rapidly as possible, driving “the foreclosure inventory rate to all-time highs.” It said that at the end of October, the number of properties going into foreclosure is “7.4 times historical averages and rising.”

The banks’ push to evict homeowners faster and in bigger numbers than ever before makes LPS’s services even more crucial to them. LPS’s success is built on its advanced, super-automated system that is highly efficient, low-cost, and speeds foreclosures through to completion. The “LPS Desktop” starts foreclosure actions, assigns work to law firms and supervises the cases to conclusion with almost no intervention by humans. (LPS says foreclosure actions are started by its clients, the loan servicers. But copies of agreements with servicers obtained by Reuters show that LPS has direct access to the banks’ and other servicers’ computer systems, and LPS detects defaults and initiates foreclosures based on parameters given to it by the banks.)

Few loan servicers could resist handing over key tasks to the company. Today, LPS boasts a client list that includes 14 of the 15 biggest loan servicers, with household names such as Wells Fargo and JPMorgan Chase — its two biggest clients, according to LPS’s most recent 10K filing with the Securities and Exchange Commission. The company has said that Bank of America joined as a client earlier this year. LPS says that all 50 of the nation’s largest banks use at least some of its services.

In essence, LPS is a giant electronic butler for the big banks and other companies in the industry. It attends to routine tasks the loan servicers prefer not to do themselves. These include tracking mortgage payments, calculating amounts owed to investors who purchased bundles of mortgages, ensuring that property taxes and insurance get paid — and automatically filing foreclosure actions when homeowners go into default.

The pending investigations and lawsuits, however, are focusing on whether LPS, in its zeal to serve its clients, broke the rules, in part by replacing missing bank documents with fictitious ones to make foreclosure cases go through.

SIGNATURE TROUBLE

The first sign of legal problems for LPS emerged earlier this year, when the company disclosed that federal prosecutors in Florida had opened a criminal investigation into apparently forged signatures on foreclosure documents prepared by DocX, the shuttered subsidiary located in a small office park in Alpharetta, Georgia.

Fidelity National Financial, LPS’s former parent, had bought DocX in 2005. The unit soon became a high-speed mill, churning out mortgage assignments — many of which are now known to be of doubtful validity — on behalf of banks and investor trusts, helping them to foreclose on homeowners.

Mortgage assignments are documents transferring ownership, usually from the original lenders to trusts owned by investors who bought securitized packages of mortgages. Loan servicers typically file foreclosure actions on behalf of the trusts when any of their mortgages go into default. But cases popping up all over the country show that the original lenders never handed over ownership of mortgages to the trusts. Assignments establishing ownership of a mortgage are required as evidence in foreclosure cases.

DocX turned out tens of thousands of newly-minted mortgage assignments, purporting to show transfers of ownership long after the mortgages should have been handed over to the trusts, according to the standard provisions in trust agreements.

Thousands of these bore the signature of DocX employee Linda Green. The signatures didn’t look alike, however, and LPS eventually confirmed that multiple DocX employees had signed her name. Some of the assignments stood out because they listed the new owner of the mortgages as “bogus assignee” or “bad bene.”

LPS spokeswoman Michelle Kersch said “bogus assignee” and “bad bene” were simply standard placeholders on document templates which the employees inadvertently had neglected to fill in with the proper names.

In his October 29 conference call with analysts, Carbiener said that when the company discovered the DocX wrongdoing in December 2009, it immediately stopped it and soon shut DocX down. But it turns out that DocX continued operating much longer than LPS originally had acknowledged. In a written response last week to questions from Reuters, LPS’s Kersch confirmed that DocX actually wasn’t closed until August 2010. She said: “The last document signed by DocX was on May 14, 2010.” But she said no improper signing had occurred there since 2009.

DUBIOUS DOCUMENTS

Hundreds of public records examined by Reuters show that production of suspect mortgage assignments was not limited to DocX.

The records indicate that employees in one of LPS’s own offices, in Mendota Heights, Minnesota, signed and notarized large numbers of documents which for multiple reasons appear invalid. Records filed with county recorders’ offices show that the Minnesota office continued to turn out these documents at least through the end of January 2010.

Dozens of assignments were signed by LPS Minnesota office employees who listed themselves as corporate officers of banks and other loan servicers, a sampling of public records from counties in five states shows. As at DocX, the assignments were signed years after the mortgages should have been transferred to the investment trusts.

The signature of one of these LPS employees, Liquenda Allotey, appears on thousands of mortgage assignments. Homeowners’ lawyers and at least one judge — federal bankruptcy judge Joel B. Rosenthal in Massachusetts — have noted that Allotey’s signature is a simple zigzag line, raising questions about whether other individuals may have signed his name. Titles listed below the signature identify him variously as “vice president” or “attorney in fact” for at least 13 banks and mortgage companies.

LPS spokeswoman Kersch said Allotey signed all of the documents himself, and said all mortgage assignments prepared in the Minnesota office “were executed under a lawful grant of authority.” She didn’t spell out, however, how such authority was given.

In any event, two other aspects of many mortgage assignments signed by Minnesota employees raise strong doubts about the documents’ legitimacy.

State laws, backed up by court decisions, require that mortgage investment trusts and others filing to foreclose on houses possess a valid mortgage assignment at the time they file for foreclosure. If it doesn’t, the laws require that the case be dismissed.

An examination of county recorders’ records turned up dozens of mortgage assignments signed and notarized by the Minnesota office weeks or months after a foreclosure case had been filed. Records show that even though invalid, the belated mortgage assignments often enabled foreclosure cases to sail through.

April Charney, an attorney who represents homeowners at Jacksonville Area Legal Aid, said in a Reuters interview that in most instances homeowners can’t afford lawyers and don’t challenge the foreclosures.

In many states, judges often approve the foreclosures without carefully examining the documents, she said. And at least until recently, when widespread questions were raised about the legitimacy of mortgage documents, judges routinely accepted belated mortgage assignments — even in cases contested by the homeowners, she said.

Equally difficult to explain are mortgage assignments signed by LPS Minnesota employees purporting to be officers of lenders that no longer existed. For example, in January 2010, two Minnesota employees jointly signed one as officers of Encore Credit Corp., defunct since 2008.

On other occasions, LPS employees signed as authorized officers of American Brokers Conduit, well after the subprime lender had been liquidated in bankruptcy. And in many instances they signed as officers of Sand Canyon Corp. In a March 18, 2009 affidavit, Sand Canyon’s president, Dale M. Sugimoto, said the company had completely exited the mortgage business in 2008 and had no mortgages to assign.

In written answers to questions, LPS spokeswoman Kersch didn’t respond directly to questions about the employees signing mortgage assignments after the foreclosures had been filed, or about signing on behalf of defunct companies. Instead, she said that the LPS employees signed mortgage assignments because lawyers who had filed foreclosure cases asked them to. She said the lawyers “decide when and if an assignment of mortgage is required.”

Shortly after the federal investigation was launched in December 2009, LPS began moving to curtail document-signing activities at the company itself. LPS says that the Minnesota office stopped signing mortgage assignments at the end of January 2010, and public records appear to confirm that. Carbiener said during the analysts meeting that LPS has now ended all signing of mortgage assignments and affidavits at the company.

Without someone to draw up replacement documents, though, LPS’s clients faced potential hardship, because so many mortgages were never assigned by lenders, as required, in the first place. Without these documents, thousands of foreclosures all over the country would come to a halt.

Reuters has learned that rather than stamping out the practice, LPS in December 2009 began transferring signing operations out of its own offices and into those of firms it has close relationships with. Kersch confirmed that LPS sent personnel to work “at client locations to assist clients during this period.”

For example, LPS arranged through a local employment service to hire about a dozen notaries, sending them to work at a new signing operation set up in the Jacksonville office of American Home Mortgage Servicing, one of LPS’s biggest clients.

Records from county recorders’ offices show that at least as recently as October, American Home Mortgage Servicing employees signed exactly the same type of questionable mortgages assignments that LPS staffers at DocX and in Minnesota had signed. These included assignments done on behalf of defunct companies like American Brokers Conduit, and after foreclosure actions already had been filed. Reuters obtained a partial list of the names of the LPS-hired notaries. Copies of mortgage assignments available publicly show that these notaries notarized many of these assignments, including ones signed on behalf of defunct companies.

In interviews, two of the notaries, who asked that they not be identified, said the American Home Mortgage Servicing office also set up a “robosigning” operation for affidavits, another type of document required in foreclosure cases. The employees who signed the affidavits were swearing that they had verified the facts listed in them, such as the specific amounts owed by homeowners.

But the two notaries, who said they were dismissed after raising questions with supervisors about the practices, said that each morning about a half-dozen American Home Mortgage Servicing employees in about an hour would sign some 200 affidavits received via LPS’s computer system, without reading them, let alone verifying the facts they contained. “In that time, come on, you have not verified figures in 200 documents. That’s impossible,” one of the notaries said.

Philippa Brown, spokeswoman for American Home Mortgage Servicing, said in an e-mailed statement that “We recently had independent audits conducted on our processes and it was found that at no time was AHMSI (American Home Mortgage Servicing Inc.) ‘robosigning’.” She confirmed that the company had used DocX until December 2009, and then “contracted with LPS” to provide it with notaries “in connection with execution of affidavits and other documents” in American Home Mortgage Servicing’s office. Concerning assignments the company signed for defunct lenders, Brown said American Home Mortgage Servicing “obtains authorization from the previous parties,” but did not explain how.

LPS acknowledged that it had sent notaries to several companies to help them set up signing operations. Kersch said: “When LPS Default Solutions group transitioned away from signing documents on behalf of its customers, in some cases it employed notaries who worked on-site at client locations to assist clients during this period.” The spokeswoman confirmed that LPS provided training at these sites, but said it was only “technical” training on using the LPS Desktop system.

TROLLING FOR CASES

It remains unclear whether LPS faces more legal risks because of its document-signing operations or because of its odd arrangement with the lawyers assigned to file foreclosure actions.

Reuters has obtained new details of how the relationship worked from copies of the “network agreements” the law firms sign with LPS, among other sources. Interviews and records from court cases show that this system often worked to the detriment of homeowners struggling to keep their homes.

LPS says that clients are the ones who pick law firms to represent them in foreclosure cases. But copies of its agreements with clients reviewed by Reuters state that the company’s clients sign up to use LPS’s network of lawyer. The agreements and depositions from lawsuits show that when a homeowner goes into default, the LPS system automatically selects a law firm in its network, sometimes using criteria set by a client, and transmits an offer of work that pops up on the law firm’s LPS Desktop screen.

The firm has no more than a couple of hours to accept the job. And if it does, it immediately agrees to pay an up-front fee to LPS. The law firms also pay LPS a monthly fee for use of the LPS Desktop system.

The company denies that it charges fees to lawyers in exchange for assignments of work. Kersch said the company charges fees strictly for the use of LPS’s computer system. Carbiener on October 29 said: “Our services are nonlegal, and are similar to any other operational cost of a law firm such as the licensing costs they pay for word-processing software or accounting software.”

But in a lawsuit deposition on January 13, 2010, Christian Hymer, an LPS first vice president, testified that the company often signs up the law firms that are part of its network. In addition, until recently, lawyers signed work agreements only with LPS, not with the loan servicers. Kersch said that currently lawyers are required to sign separate agreements both with LPS and the servicers.

Laws in nearly all states forbid lawyers to share legal fees with nonlawyers. The laws are intended to prevent kickbacks for funneling legal work to an attorney, the cost of which would be passed on to unsuspecting clients or, as in foreclosure cases, billed to homeowners.

LPS isn’t a law firm. The Mississippi class action suit alleges that LPS is a nonlawyer middleman between the servicers (acting on behalf of trusts that own the mortgages) and the lawyers. It alleges that the company illegally decides which law firms get to file foreclosure cases, and makes decisions about what they file.

RED, YELLOW, GREEN

Interviews, deposition transcripts and LPS’s own records underline that the company keeps its clients happy and maximizes its own fee income by whipping law firms to gallop cases through the courts.

The law firms are on a stopwatch: Kersch confirmed that the LPS Desktop system automatically times how long each firm takes to complete a task. It assigns firms that turn out work the fastest a “green” rating; slower ones “yellow” and “red” for those that take the longest.

Court records show that green ratings go to firms that jump on offered assignments from their LPS computer screens and almost instantly turn out ready-to-file court pleadings, often using teams of low-skilled clerical workers with little oversight from the lawyers. Copies of company newsletters from shortly before LPS was spun off show that the company each year gave awards to the law firms that were consistently the fastest.

Firms that move more slowly were slapped with “red” designations. For them, work offers dried up.

LPS denies that the rating system is used to punish slower firms. Kersch said the ratings are generated so that law firms can compare their speed and efficiency with an average calculated for a wide group of firms.

LEGAL AFFAIRS

The term “robosigners” was coined to describe the low-level clerical workers who signed many thousands of affidavits for foreclosure cases, swearing to the truth of facts they had never checked. But it turns out that the professionals at these firms — the attorneys who have strict legal and ethical obligations to file truthful documents in court — have carried out similar activities on a large scale. They allowed others to sign their names to multiple types of court pleadings they had never read or bothered to check, involving many types of documents.

In an April 2009 court decision, Diane Weiss Sigmund, a federal bankruptcy judge in Philadelphia, specifically faulted lawyers whose firm filed LPS-transmitted documents in court using clerical workers to sign the name of a lawyer who hadn’t looked at them.

In that case, it turned out that, contrary to the documents supplied via the LPS system, the homeowners weren’t in default on their mortgage.

Referring to the LPS computer system, the judge stated, “the flaws in this automated process become apparent.” She added: “An attorney must cease processing files and act like a lawyer.”

Jacksonville legal aid attorney Charney says that carelessly prepared documents, containing basic errors, have been used to foreclose on a big portion of the homeowners who have lost their houses.

LPS denies that its system encourages carelessness by law firms. In the October 29 conference call, Chief Executive Carbiener said that based on routine internal reviews, “we are not aware of any defects in our signing and review processes that resulted in the wrongful foreclosure of any borrower.”

(Editing by Jim Impoco and Claudia Parsons)

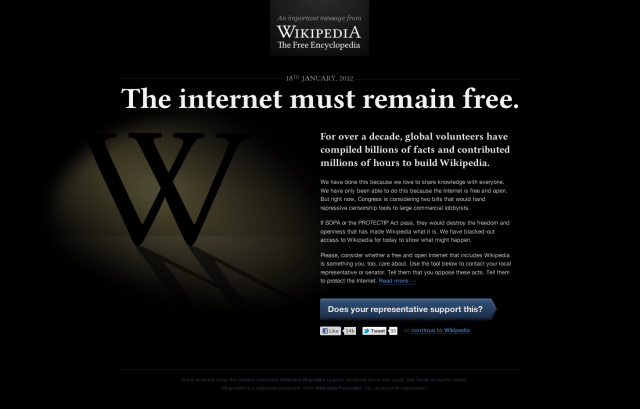

A number of websites are (or were) planning to “go black” this week while the U.S. Congress discusses issues related to the Stop Online Piracy Act (SOPA) and the Protect IP Act (PIPA). The website blackouts are part of a larger social media effort against the bills that our Greg Finn

A number of websites are (or were) planning to “go black” this week while the U.S. Congress discusses issues related to the Stop Online Piracy Act (SOPA) and the Protect IP Act (PIPA). The website blackouts are part of a larger social media effort against the bills that our Greg Finn

Jimmy Wales@jimmy_wales

Jimmy Wales@jimmy_wales

View Larger Images

View Larger Images